In October 2018, the complaints process closed to individuals with claims against the Royal Bank of Scotland’s notorious Global Restructuring Group. Individuals and SMEs are now starting to receive updates on their complaints with some receiving outcome letters.

Your complaint to GRG

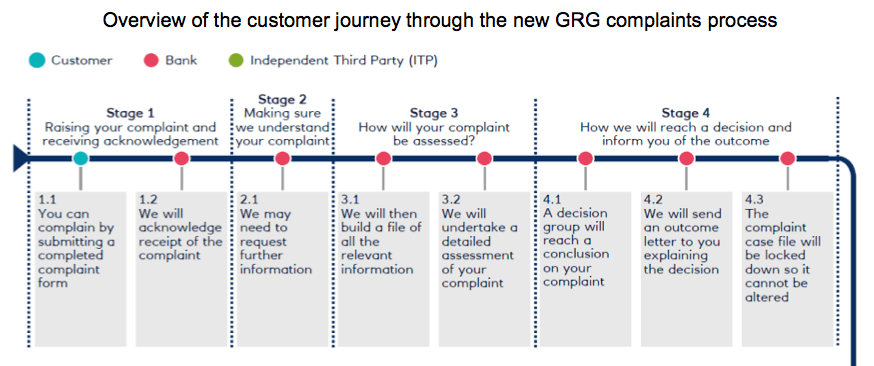

The complaints process is a lengthy one and RBS have provided information on each of the stages on their website.

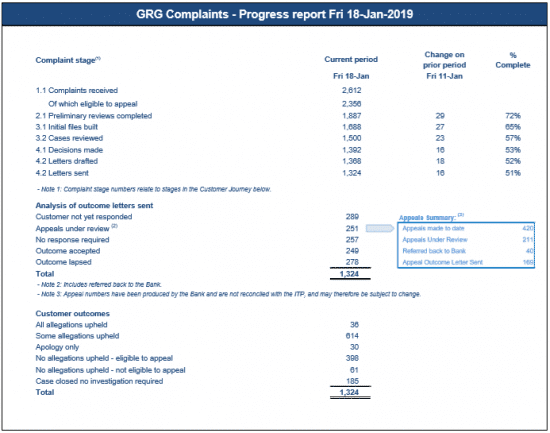

The Bank is also publishing a weekly progress report together with information on some of the outcomes of consequential loss claims.

GRG Appeals

If you are unhappy with your GRG complaint outcome, you may have the opportunity to appeal. As at 25th January, RBS GRG had received 2,615 complaints 2,359 of which were eligible for appeal.

Who will conduct the GRG complaints appeal?

The Independent Third Party is Sir William Blackburne, a retired high court judge. Sir William has been appointed by RBS to oversee the bank’s new GRG Complaints Process, and to consider any Appeals.

The ITP is funded by RBS and reports into the Financial Conduct Authority (FCA) and the Board of RBS.

Sir William’s role is to provide external independent scrutiny to the Complaints Process, and help ensure that fair outcomes are reached for customers.

How to appeal

You can appeal all of your complaint outcome or part of it.

To appeal, you must complete the appeal form enclosed with your decision letter, setting out exactly which parts of the complaint you are appealing.

There is a 56 day deadline (from the date of your outcome letter) by which to submit your appeal.

Contact details for the GRG Appeal team:

GRG team: [email protected]

Appeals: [email protected]

Telephone: 0800 0294 370

Address: Independent Third Party Review, PO Box 74346, London, EC3P 3DU

What will happen to my offers if I appeal?

If you appeal a Direct Loss offer, that Direct Loss offer will lapse once you submit your Appeal Form, and will be replaced by the amount that the ITP decides is appropriate.

On appeal the ITP will reassess the amount of Direct Loss that should be paid. Consequently, it is possible for the ITP to change the Direct Loss offer. This could be more or less than the amount originally offered to you. It is possible for the ITP to dismiss the offer altogether.

Once you receive a Final Outcome letter, which will incorporate the outcome of your Appeal in full and any other offers that were carried forward from your first Outcome Letter, you will have 28 days to appeal the same.

If you have received an outcome letter from GRG and you are unhappy with the decision but eligible to appeal, we can assist you in the process. Get in touch to arrange a consultation with our Financial Services Litigation team.

Consequential Loss claims

Some customers whose complaints are upheld, may feel that they suffered a consequential loss which has not been adequately compensated for in the bank’s offer. In such circumstances they may submit a claim for consequential loss.

We have assisted many clients in consequential loss claims both in complaints to RBS and in litigation. If you consider you have a consequential loss claim, get in touch to book a consultation as soon as possible.

LEXLAW Banking Litigation & Dispute Resolution

It is an absolute must that victims of RBS GRG or other bank BSUs protect their legal rights. This is the only sensible course of action when a business is facing a high value dispute with a major bank, such as the Royal Bank of Scotland or National Westminster Bank. Otherwise, if there is no redress scheme, or if the bank refuses to offer reasonable redress, customers may well find they are time-barred from commencing legal action and their high value claim is now worthless. Legal rights can be protected by taking urgent legal advice and by instructing specialist GRG solicitors to issue a protective claim form or by instructing GRG litigation solicitors to prepare and agree a carefully written standstill agreement.

Our Financial Services Litigation team of Solicitors and Barristers in London are highly experienced in banking litigation and specialise in representing SMEs in banking disputes. Our high profile and high value cases regularly appear in the national and international media. Our banking litigators advise on the protection of borrower legal rights in the face of predatory bank practices. We have successfully managed and settled court litigation against all major UK banks. Call us on 02071830529 or complete our online contact form.

Financial Services Litigation Team, LEXLAW