Following the publication of the Tomlinson Report into the Royal Bank of Scotland’s treatment of SME’s, another report by Sir Andrew Large has called for an urgent review of the way businesses are treated by banks turnaround divisions such as RBS’s Global Restructuring Group (“GRG”).

Sir Andrew Large was asked by RBS to conduct an independent review into RBS’s SME lending; he took into account various sources including the damning Tomlinson Report and concluded that some of the banks’ customers had a strongly negative perception of RBS, in particular related to their treatment as a business in financial distress. The RBS commissioned report criticises GRG’s governance and its communications procedures, recommending that the bank look into the treatment of SME’s in the turnaround division.

RBS Independent Lending Review: Sir Andrew Large’s Findings on RBS Global Restructuring Group (GRG)

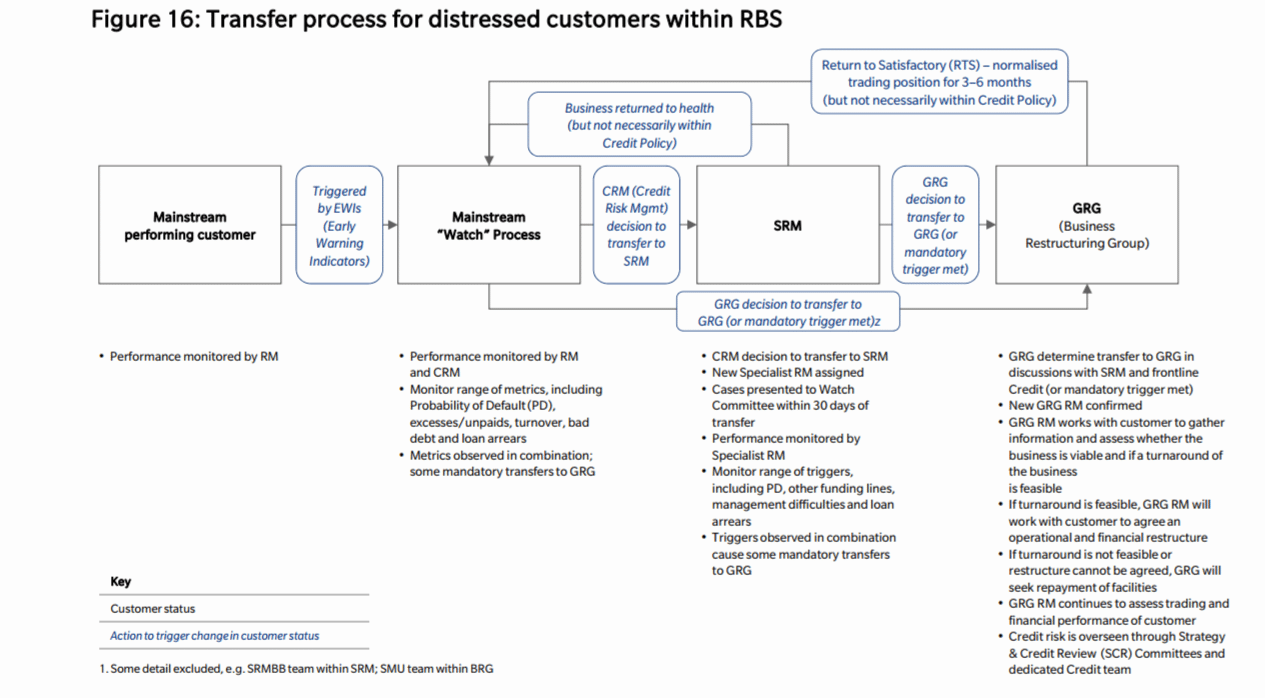

The RBS commissioned report highlighted the aim of RBS’s Global Restructuring Group as managing distressed SME customers and nursing them back to health. GRG had the responsibility of turning businesses in financial difficulty around and sending them back to the mainstream Business & Commercial business area. The following flow chart taken from the report shows the bank’s internal transfer process for distressed business customers within RBS:

However, Sir Andrew Large found that:

- GRG is run as an “internal profit centre”, with its profit and loss account based on the incremental income that it generates for the bank, less its operating costs. Yet GRG retains the ultimate authority over which customer relationships are transferred to it. In practice, decisions to transfer customers to GRG are usually initiated by the (Specialised) Relationship Manager or Credit Officer within B&C (in consultation with GRG). However, GRG officially retains the ultimate decision making authority rather than an independent body, and there are no other procedural checks and balances in place (such as a negotiated transfer price between B&C and GRG)

- GRG also has responsibility for the move from turnaround to resolution and recovery. Once responsibility for managing the relationship with a customer has been transferred to GRG, B&C has limited visibility over the actions taken and decisions made by GRG, regardless of whether the objective is turnaround or recovery and resolution. The governance process for the critical decision of whether a business has reached the point of non-viability is therefore opaque both to B&C and to the SME itself, which may be unaware or unprepared for the consequences of the change

Sir Andrew Large commented that “the decisions and actions taken by the bank can be highly unsettling and emotional for the customer” and that “they will likely impact the livelihoods of the individuals and families who own and run the SMEs in question”. He also found that the individual SME “may be unaware or unprepared for the consequences of the change”, and highlighted the lack of recourse available to customers in such situations, stating that “SMEs typically lack the funds or expertise required to challenge the banks in protecting their interest”.

Sir Andrew Large Urges Review into Bank’s Treatment of SME’s in Turnaround Divisions such as RBS GRG

Sir Andrew Large echoed Dr Lawrence Tomlinson’s findings and told the Financial Times the lack of governance and safeguards at Britain’s biggest lender to SMEs could be replicated elsewhere.

“RBS needs to address the concerns that have been raised by some customers and external stakeholders about its treatment of SMEs in financial distress and minimise the perceived conflict of interest within GRG. This would be best achieved through a forensic inquiry to substantiate or refute serious accusations that have been made.”

Following the publication of both reports, RBS announced that they would be carrying out an internal investigation and reporting their findings in due course.

Lawrence Tomlinson’s report can be read here: Tomlinson Report (PDF) & Tomlinson Report (Text)

Sir Andrew Large’s report can be read here: RBS Independent Lending Review Report (PDF) & RBS Independent Lending Review Report (Text)