“Rope: Sometimes you need to let customers hang themselves.” A damning 2009 internal memo entitled “Just Hit Budget!” was published on 17 January by the Treasury Select Committee as MPs ramp up their investigation into RBS’s Global Restructuring Group’s mis-treatment of SME’s.

The leaked tipsheet, which according to a secret report being withheld from publication by the FCA, was not an isolated example of the misconduct of RBS. The memo highlights the underhand pressure tactics deployed by GRG to close deals and squeeze owners of struggling businesses for profit. Many SME customers claim they were pushed to the brink and restructured for profit by GRG. The memo- written by a manager- was circulated among staff and represents a step by step guide on how to swindle their customers.

Protecting Legal Rights against RBS GRG

It is an absolute must that victims of RBS GRG or other bank BSUs protect their legal rights. This is the only sensible course of action when a business is facing a high value dispute with a major bank, such as the Royal Bank of Scotland or National Westminster Bank. Otherwise, if there is no redress scheme, or if the bank refuses to offer reasonable redress, customers may well find they are time-barred from commencing legal action and their high value claim is now worthless.

Legal rights can be protected by taking urgent legal advice and by instructing specialist GRG solicitors to issue a protective claim form or by instructing GRG litigation solicitors to prepare and agree a carefully written standstill agreement.

The Transcript of the “Just Hit Budget!” Memo

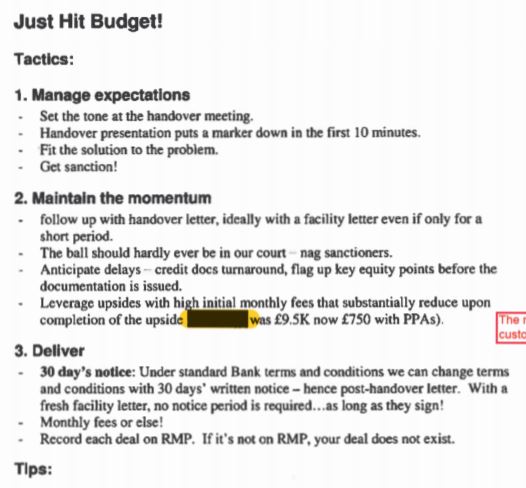

Just Hit Budget!

Tactics:

1. Manage expectations

– Set the tone at the handover meeting.

– Handover presentation puts a marker down in the first 10 minutes.

– Fit the solution to the problem.

– Get sanction!

2. Maintain the momentum

-follow up with handover letter, ideally with a facility letter even if only for a short period.

-The ball should hardly ever be in our court – nag sanctioners.

-Anticipate delays – credit docs turnaround, flag up key equity points before the documentation is issued.

-Leverage upsides with high initial monthly fees that substantially reduce upon completion of the upside [REDACTED] was £9.5K now £750 with PPAs).

3. Deliver

–30 days’ notice: Under standard Bank terms and conditions we can change terms and conditions with 30 days’ written notice – hence post-handover letter. With a fresh facility letter, no notice period is required … as long as they sign!

-Monthly fees or else!

-Record each deal on RMP. If it’s not on RMP, your deal does not exist.

Tips:

–Use facility letters: If they sign, they can’t complain. Heads of Terms cannot be enforced.

–Basket cases: Time consuming but remunerative.

–Perfect deals: they don’t exist – if [REDACTED]’s unhappy and customer’s unhappy then you probably have the balance right.

–Deal or no deal? No deal, no way. Missed opportunities will mean missed bonuses. You can always revisit an earlier deal.

–Handover debt: if you formalise the handover debt: not new money but customer likely to sign the facility letter to confirm the new limit, avoids immediate excesses and locks in immediate income.

–Be specific: avoid round number fees – £5,300 sounds as if you have thought about it, £5K sounds like you haven’t.

–Rope: Sometimes you need to let customers hang themselves. You have then gained their trust and they know what’s coming when they fail to deliver.

–Never: Issue “until further notice” overdraft letters.

16 Ways to generate Income:

1. Monthly fees: minimum £500. Ideally on average we need c10% premium on our debt (current return will be <5%, mezz return should be about 15%). E.g. Debt £2m suggest £200K premium i.e. monthly fee £16K! They normally cannot afford this and you can then leaverage an upside. Set up recurring income action on RMP. Diary note for when they expire.

2. Exit fees: Normally monthly 0.5% of all the balances to drive a re-finance. Consider ratcheting. Useful for property developments.

3. Facility fees: Aim for 2% but if doing a restructure aim much higher although may have to add to our debt.

4. Redemption premiums/Other upsides: Include in new loan facilities if significant (min. 10% premium) and deferred e.g. £50K in 6 months time then record as “other upside”. Use with caution.

5. Conditional Support Fees: E.g. equity concluded by date X or fee £Y applies – helps deliver a deal or secure income if deal falls away.

6. Default Interest Rates: Check each loan facility prior to handover, formal notice of default required, refer to the paragraph, change back office and register the margin enhancement. Need to allow 3 days for them to remedy the breach.

7. IIS: Care – no margin enhancements and no fees, but if a refinance likely then you can claim back all the IIS! [REDACTED] £600K). Also turns off Bankline, practically may have to have IIS only on loans.

8. Excess fees: Charge for any pre-notified excess.

9. Non-receipt of MI: Minimum £100 per month.

10. Margin enhancement: Minimum margin should be as per Bank matrix unless/until you agree an upside. Claim the margin until new limits formalised.

11. New money: With a new money action on RMP you can claim ALL the margin on the new money

12. Royalty fees: If equity going to have no value, consider a percentage of turnover (formal documentation available).

13. Service charge: We should have everyone on standard tariff.• [REDACTED] and [REDACTED] can help.

14. RBSIF: You can claim one off “notional income” for the margin on RBSIF facilities if they drawdown and you introduce them. E.g. RBSIF drawdown with £1m funds in use limit at 3% margin – you get £30K income.

15. GBM: They should email us with income elements of SWAPs etc. when they enter them and when they redeem.

16. Security fees: Standard pricing per item per the standard Commercial Bank tariff to apply – on taking as well as on releasing.

Financial Services Litigation Team, LEXLAW