Is a company in the UK not paying your invoice? What options are there for Chinese companies that are owed money in the UK? Should a Chinese business commence legal action in the UK? We are expert debt recovery lawyers in London, and we specialise in collecting high value commercial debts from all companies and businesses in the UK.

We have acted for a number of companies, businesses and suppliers in China and are able to offer translation services for English to Mandarin and Mandarin to English. This means we are able to take full, clear instructions from you (even if you do not speak English).

To date, we have a 100% success rate and all legal actions issued in the UK Courts has been resolved in our client’s favour. This has also meant that the petitioned UK debtor company has paid our legal fees as well. Luckily for our clients this means instructing us to pursue their bad debts has ultimately recovered the sums owed plus interest with a refund of their legal costs. As a result of our success we are now able to offer clients a proactive debt recovery package for a small fixed fee (which is likely to be refunded).

Our Chinese Debt Recovery Legal Services

Our lawyers act for international clients based in mainland China, Hong Kong and Taiwan.

Our UK solicitors have acted for many Chinese companies chasing payments of unpaid invoices from UK companies. Understanding the nuances of a foreign UK legal system will be challenging for our clients based in China, so let our expert lawyers take your case and recover your debt.

If your company has a large number of debtors in the UK, we can accept bulk instructions. Instruct us to get the money that is owed to you.

UK debt recovery service for Chinese companies

We represent Chinese companies seeking to be paid overdue invoices and can help recover the debt that is owed from UK companies. If you have chased for payment and been ignored, then we can help you. We charge a discounted fixed fee to give preliminary legal advice in a video or telephone conference which includes our interpreter. Our interpreter is highly experienced and regularly assists the UK government, justice system and the courts.

We will advise you of all the debt recovery options in the UK and allow you to choose the one that best suits your needs. Often we are able to then pursue the rest of the debt on a fixed fee or no win no fee basis.

How can a Chinese company recover bad debts in the UK?

Chinese businesses owed debt from someone in England & Wales can get their customer to pay an unpaid or overdue invoice in the following ways:

- Send a pre-action debt recovery warning email or letter;

- Threaten legal action in a letter of claim;

- Negotiate a payment plan / settlement with the debtor;

- Instruct specialist UK debt recovery solicitors to correspond with the debtor company;

- Serve a formal statutory demand;

- Commence County Court or High proceedings; or

- Serve a winding-up petition.

What if a customer in the UK will not pay: Warning letter for outstanding payments

If a UK debtor company, client or customer is ignoring your invoices and have ignored your demands for payment, then you can instruct us as specialist debt recovery solicitors to send a formal demand for payment.

In certain cases, a formal letter before action from UK solicitors warning the debtor of court enforcement action should the debt not be paid is enough to prompt the defaulting company to pay sums owed to you. Those who take action first are the ones most likely to be paid. We will send polite but firm correspondence where there is an ongoing customer relationship.

Claim late payment compensation from UK companies that owes you money

If you have been paid late on an invoice rendered commercially, then your business could be entitled to compensation from the debtor under the Late Payment of Commercial Debts (Interest) Act 1998. If an invoice is not paid on time, then a creditor is entitled to claim compensation from a debtor- even if there was no provision for interest or late payment in the invoice.

Late payment compensation under the Late Payment of Commercial Debts (Interest) Act 1998 is as follows:

| Amount of the unpaid debt | Late payment compensation |

| Up to £999.99 | £40 |

| £1,000 to £9,999.99 | £70 |

| £10,000 or more | £100 |

Recover debt from UK companies: Serve a statutory demand to formally demand payment

If you have still not received payment of an unpaid invoice after, for example, chasing for payment, mediation, attempting to negotiate a payment plan then you have the right to take legal action against the debtor to recover money that is owed to you.

A statutory demand is the first legal step to winding up a debtor company in England, Wales, Scotland or Northern Ireland, if the debt is for more than £750. A statutory demand is capable of being served as soon as the debt is due and is best done by a solicitor in the UK.

Chinese creditors often serve a statutory demand as a more cost-effective and speedier method to ensuring the debtor pays the debt rather than instigating court proceedings (initially anyway). Preparing and serving the statutory demand (depending on the quantum of the debt and the facts of an individual case) could potentially be done relatively quickly (with the cost of a process server included). Given that this process does not involve the Court, there are no added court fees or delays seeking listings of applications (unless the debtor challenges the statutory demand e.g. if the debt is disputed).

A statutory demand starts the time running for a debtor to honour its debts, as once served, the debtor has 21 days within which to pay the debt.

Moreover, a statutory demand carries a threat of winding up the debtor company, and could focus the mind of a director to ensure re-payment of the sums is expedited or engage in settlement negotiations.

Wind-up a UK Limited Company that has unpaid invoices

A creditor based in China has the right to instruct a solicitor to wind-up the debtor company to recover debts which exceed £750, or to stop the company making its debts worse.

An application is made to the insolvency court in London (this is the petition) to seek an order to wind the company up.

The Court will grant a hearing date to “hear” the petition. If the company does not respond, or if no defence is mounted, then it is usually a matter of the judge issuing the order to wind up.

Upon winding up all the assets of the company are collected and distributed amongst creditors and then you are entitled to take enforcement action against the debtor.

We represent businesses in China at UK Court hearings

We are based in the legal heart of London, operating as the only law firm in the historic Middle Temple Chambers, and we provide comprehensive nationwide coverage throughout England & Wales to represent your interests as a creditor at any court hearing and winding up petition hearing.

We will represent you at any court hearing and will provide our own barristers or external local counsel to any hearing across the country.

Are you based in China? We provide international debt recovery services

That does not matter, we will represent you no matter where you are based internationally.

If you contact us through our contact form, by email or by phone, one of our debt recovery legal team members will contact you by phone to discuss your matter and assess whether we can help you.

If we can, we will arrange a conference with a senior member of our winding up petition team. This meeting will take place either in person or using our telephone conference facilities, via Skype, Zoom or WeChat if you prefer. Therefore, no matter where you are based in the world we can represent you.

Instruct Specialist UK Debt Recovery Solicitors for Chinese Creditors

We are specialist Insolvency Lawyers and have helped Chinese businesses recover all the debt that is due to it. We can claim interest and compensation from debtors on your behalf; send late payment demands; letters before claim and issue Court proceedings (claiming the debt, interest, compensation and reasonable costs of debt recovery); and enforce Court judgments.

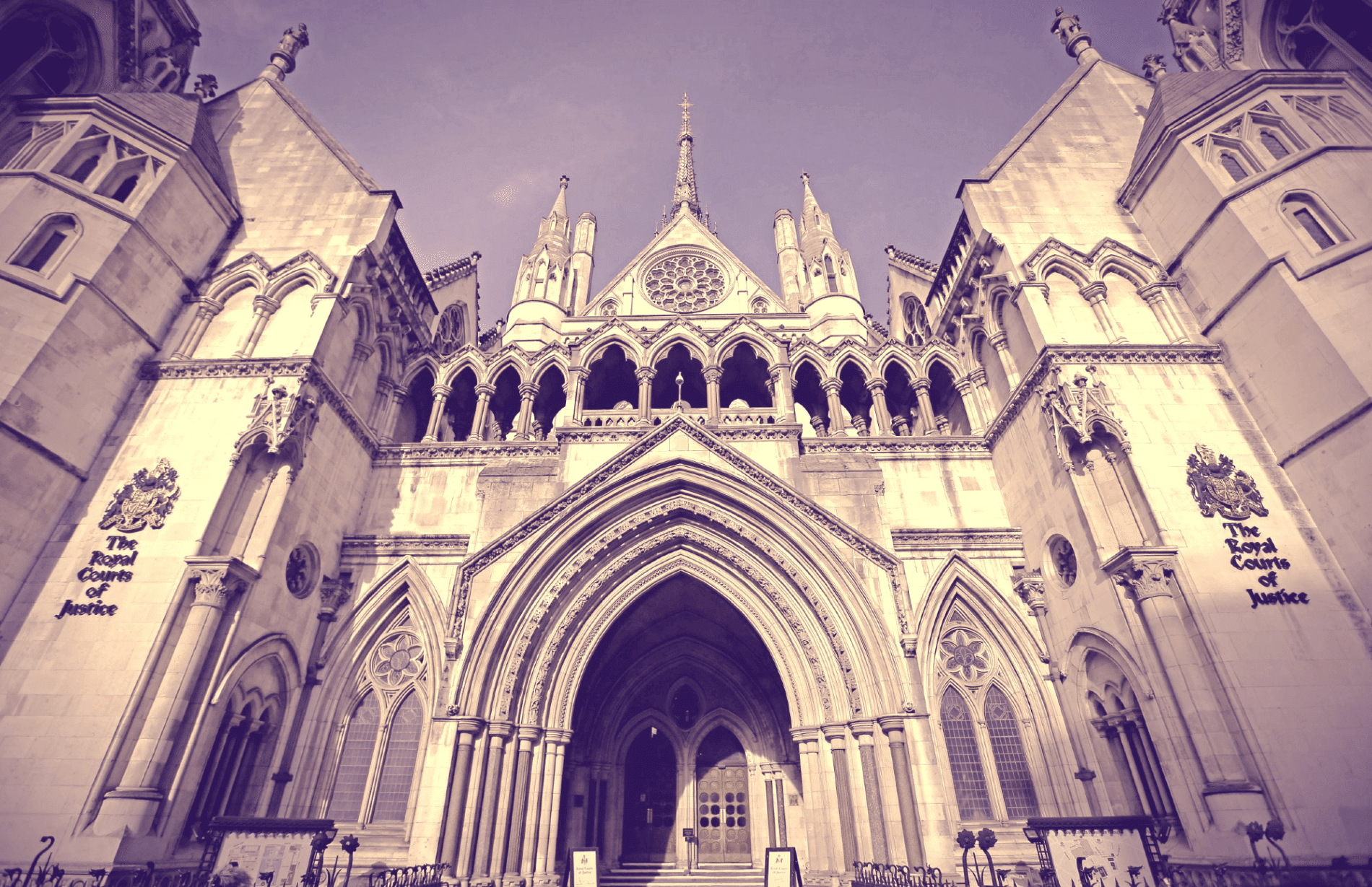

We are a specialist City of London law firm made up of Solicitors & Barristers and based in the Middle Temple Inns of Court adjacent to the Royal Courts of Justice. We are experts in dealing with matters surrounding insolvency in particular issues. Our team have unparalleled experience at serving statutory demands, negotiating with debtors/creditors, setting aside statutory demands and both issuing and defending winding up petitions vigorously at the Royal Courts of Justice (Rolls Building), or the relevant High Court District Registry or County Court with jurisdiction under the Insolvency Rules.