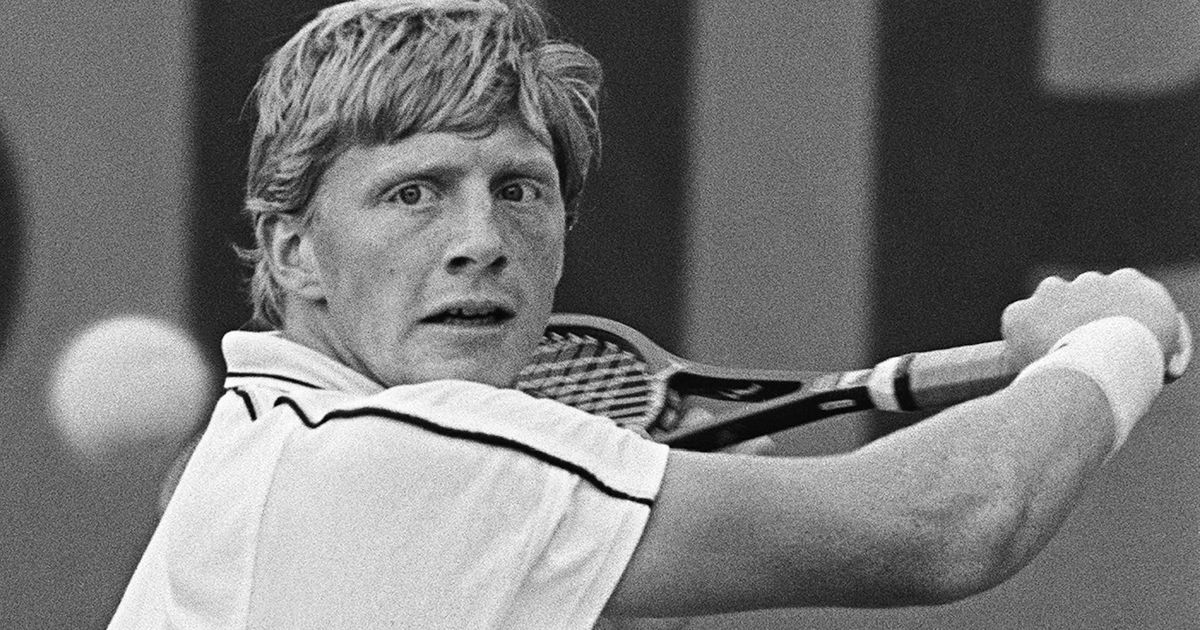

The case of Boris Becker, the former tennis champion and Wimbledon legend, stands as a cautionary tale within the area of bankruptcy law. Becker’s trajectory from sports stardom to financial turmoil culminated in a prominent bankruptcy case that garnered extensive attention from both the legal community and the public. This case study explores the complexities of Becker’s bankruptcy, the legal obstacles he encountered, and the broader implications for bankruptcy proceedings in the UK.

Declared bankrupt in June 2017, Becker was obligated to disclose all his assets to the appointed trustees. However, he was later found guilty of concealing significant assets, leading to his conviction under the Insolvency Act 1986. The bankruptcy application was initially made by private bankers Arbuthnot Latham & Co in connection with a judgment debt owed to them by Becker dating back to 2015.

Check Your Bankruptcy Annulment Dispute Case ✔

We analyse your case prospects. We deliver strategic legal advice at your first meeting. We get optimal legal results. Want a first or second opinion on your case? Click below or call our lawyers in London on ☎ 02071830529

What did Becker Conceal?

Becker was legally required as per s. 333 and s.251J of the Insolvency Act to disclose all his assets to the trustees for the benefit of his creditors. He was accused of hiding several assets during his bankruptcy proceedings as per ss. 353 and 354 of the 1986 Act, which included:

- A property in his hometown of Leimen, Germany, valued at approximately £1 million;

- A bank loan of about £700,000 on the property in Leimen;

- 75,000 shares in a technology firm, Breaking Data Corp., valued at approximately £66,000;

- Additionally, he was found to have transferred €426,930.90 to various third parties.

These actions were part of the reasons why Becker was convicted under the Insolvency Act, 1986 and was thereafter imprisoned in 2022. The concealment of these assets was considered a serious offense as it hindered the ability of the trustees to distribute funds to his creditors accordingly.

Becker’s Conviction and Sentencing

In April 2022, Becker was found guilty of four charges under the Insolvency Act, 1986. The charges included the removal of property, two counts of failing to disclose estate, and concealing debt. As a consequence Becker was sentenced to two and a half years in prison. The severity of the sentence underscored UK’s stringent approach to bankruptcy fraud. UK’s legal framework for bankruptcy is designed to be rigorous and fair, ensuring that individuals who are unable to pay their debts can have a fresh start, while also protecting the rights of creditors. The Insolvency Act of 1986 and the Insolvency Rules of 2016 are key pieces of legislation that outline the responsibilities and restrictions placed on individuals who declare bankruptcy, and the overall scheme of law that govern the matter.

Becker’s Appeal against the Conviction

Becker did appeal the court’s decision regarding his bankruptcy. In May 2024, the appeal was successful, and he was officially discharged from bankruptcy after the insolvency court found that he had done “all that he reasonably could do” to repay his creditors. The court acknowledged his efforts to settle his debts, which included a substantial sum into the bankruptcy estate.

The grounds of appeal in Becker’s case were centered around the suspension of his automatic discharge from bankruptcy, and included:

- Suspension of Discharge: Becker’s legal team argued against the Bankruptcy Order passed in 2018 that suspended the running of time for his discharge from bankruptcy. The suspension was initially put in place because Becker had not complied with his obligations under the Insolvency Act;

- Settlement Deed: Becker’s appeal included a request for an order compliant with the rules, discharging the 2018 Order based on a Settlement Deed dated November 15, 2023. This deed was entered into between Becker, the joint trustees of his bankruptcy estate, and another party;

- Privacy of Settlement: The appeal also sought an order under the rules that the Settlement Deed must not be made available for inspection without the permission of the court, which the joint trustees agreed to; and

- Fulfillment of Obligations: The appeal highlighted that Becker had done “all that he reasonably could do” to fulfill his financial obligations, which included providing a substantial sum into the bankruptcy estate.

Throughout the proceedings, Becker’s financial struggles were also highlighted, with his barrister stating that his career and prospects of earning an income were destroyed, leaving his reputation “in tatters” and him with “literally nothing”.

This discharge marked the end of a significant legal and financial ordeal for the former tennis star.

Download the Judgment here:

What was the Role of Trustees in Becker’s case?

In Becker’s bankruptcy case, the role of the joint trustees, who derive authority from s.314 of the Insolvency Act, was crucial. They were responsible for managing Becker’s bankruptcy estate and ensuring that his assets were properly accounted for and distributed to creditors. Key responsibilities they had included:

- Asset Management: The trustees would oversee the identification and valuation of Becker’s assets, ensuring that all non-exempt assets were available for distribution to creditors.

- Financial Investigation: Trustees would conduct a thorough investigation into Becker’s financial affairs to uncover any undisclosed assets or transactions.

- Asset Recovery: In cases where assets were hidden or transferred to avoid repayment, the trustees would work to recover these assets for the benefit of the creditors.

- Legal Proceedings: The trustees would initiate legal proceedings if necessary, to challenge any improper transactions or preferences given to certain creditors.

- Distribution of Assets: Once all assets were accounted for and any legal challenges resolved, the trustees would distribute the proceeds from the sale of assets to the creditors according to the priority established by bankruptcy laws.

- Communication with Creditors: They would maintain communication with the creditors, informing them of the progress and outcomes of the bankruptcy proceedings.

- Settlement Agreement: The trustees played a vital role in negotiating the Settlement Deed, which was a key part of his appeal and subsequent discharge from bankruptcy.

The joint trustees’ actions are governed by bankruptcy laws and regulations, and they act as intermediaries between the debtor and the creditors to ensure a fair and legal resolution of the bankruptcy case. By not disclosing all of his assets, Becker hindered the bankruptcy trustees’ ability to distribute funds to his creditors, which is a fundamental requirement in bankruptcy proceedings, as stipulated under .

How did Becker’s case impact Bankruptcy laws in the UK?

Becker’s case has had a notable impact on the perception and enforcement of bankruptcy laws and regulations in the UK. While the case itself may not have directly resulted in new legislation, it has certainly highlighted the importance of compliance with bankruptcy procedures and the consequences of failing to do so.

Here are some ways in which the case has influenced the bankruptcy landscape:

- Increased Scrutiny: The high-profile nature of the case has led to increased scrutiny of bankruptcy proceedings, especially involving celebrities and public figures. The case showed that no one is above the law and even prominent individuals must adhere to the rules and regulations.

- Public Awareness: The case has raised public awareness about the seriousness of bankruptcy fraud and the legal obligation to declare all assets. It has emphasised the need for transparency in financial disclosures during bankruptcy.

- Enforcement of Bankruptcy Restrictions: Becker’s case has underscored the enforcement of bankruptcy restrictions and the potential for extended restrictions in cases of non-compliance. His 12-year Bankruptcy Restriction Undertaking serves as a warning to others about the long-term consequences of hiding assets.

- Legal Precedent: The case sets a legal precedent for future bankruptcy cases, where individuals might attempt to conceal assets. It provides a reference point for courts in determining the severity of penalties for similar offenses.

- Trustee Vigilance: Trustees may now be more vigilant in investigating the affairs of bankrupt individuals, ensuring that all assets are accounted for and properly distributed to creditors.

To summarise, while the Becker case may not have changed the laws themselves, it has certainly impacted their application, enforcement and the general approach to bankruptcy proceedings in the UK. It serves as a reminder of the importance of fulfilling legal obligations during bankruptcy and the potential repercussions of failing to do so.

What are the consequences of Bankruptcy Fraud in the UK?

Becker’s case illustrates the severe consequences of bankruptcy fraud, including legal penalties, imprisonment, financial repercussions and reputational damage. It serves as a stark reminder of the importance of transparency in financial disclosures during bankruptcy.

The consequences of bankruptcy fraud in the UK are quite severe, as demonstrated by the Boris Becker case. An overview of the potential repercussions is detailed hereunder:

- Prison Sentence: Individuals found guilty of bankruptcy fraud can face imprisonment.

- Financial Penalties: The court may impose fines in addition to or instead of imprisonment.

- Bankruptcy Restrictions: A person convicted of bankruptcy fraud may be subject to bankruptcy restrictions for a longer period than usual. These restrictions can include limitations on borrowing money, acting as a company director, or managing a business.

- Loss of Professional Reputation: The stigma associated with a fraud conviction can lead to a loss of professional standing and opportunities.

- Asset Forfeiture: Assets that were hidden or not disclosed during the bankruptcy process can be seized and sold to pay off creditors.

- Extended Bankruptcy Discharge: The period before an individual is discharged from bankruptcy can be extended, delaying their financial fresh start.

- Public Record: A bankruptcy fraud conviction becomes a matter of public record, which can have long-term negative implications for an individual’s credit rating and ability to secure loans or mortgages.

- Bankruptcy Restriction Undertaking (BRU): In some cases, an individual may voluntarily agree to a BRU, which imposes similar restrictions to a Bankruptcy Restrictions Order (BRO), but without the need for court proceedings.

The UK’s Insolvency Service and the courts take a strong stance against bankruptcy fraud to maintain the integrity of the financial system and protect the rights of creditors. Becker’s case serves as a reminder of the serious legal consequences that can result from attempting to deceive creditors or the court in bankruptcy proceedings.

The Becker bankruptcy case is a testament to the rigorous enforcement of bankruptcy laws in the UK. It demonstrates the potential consequences of non-compliance and the critical role of trustees in safeguarding the bankruptcy process. As Becker moves forward from his legal challenges, the case remains a significant point of reference for legal professionals as well as individuals navigating the complexities of bankruptcy.

Book an initial consultation with expert Bankruptcy Solicitors and Barristers

We are a specialist City of London law firm made up of Solicitors & Barristers and are based in the legal heart of London in Middle Temple (one of the four prestigious barristers’ Inns of Court) adjacent to the Royal Courts of Justice.

We are experts in dealing with matters surrounding bankruptcy including defending bankruptcy petitions; managing bankruptcy applications (including annulments); advising on bankruptcy petitions and offences; and liaising with the Official Receiver. Whilst we are based in London we provide national coverage across all Courts in England & Wales.

Check Your Bankruptcy Annulment Dispute Case ✔

We analyse your case prospects. We deliver strategic legal advice at your first meeting. We get optimal legal results. Want a first or second opinion on your case? Click below or call our lawyers in London on ☎ 02071830529