The Times Brief reports that a company with a Queen’s award for its work in boosting British entrepreneurs is suing two of the country’s biggest banks after they refused to pay up for allegedly mis-selling the not-for-profit business a complicated financial product that went wrong.

Lawyers for Wenta – a Watford-based company that kick-starts new businesses and whose chairman last year was given a lifetime achievement award by the Queen – claim that the disastrous deal cost the business more than £500,000 and could drive it to the wall.

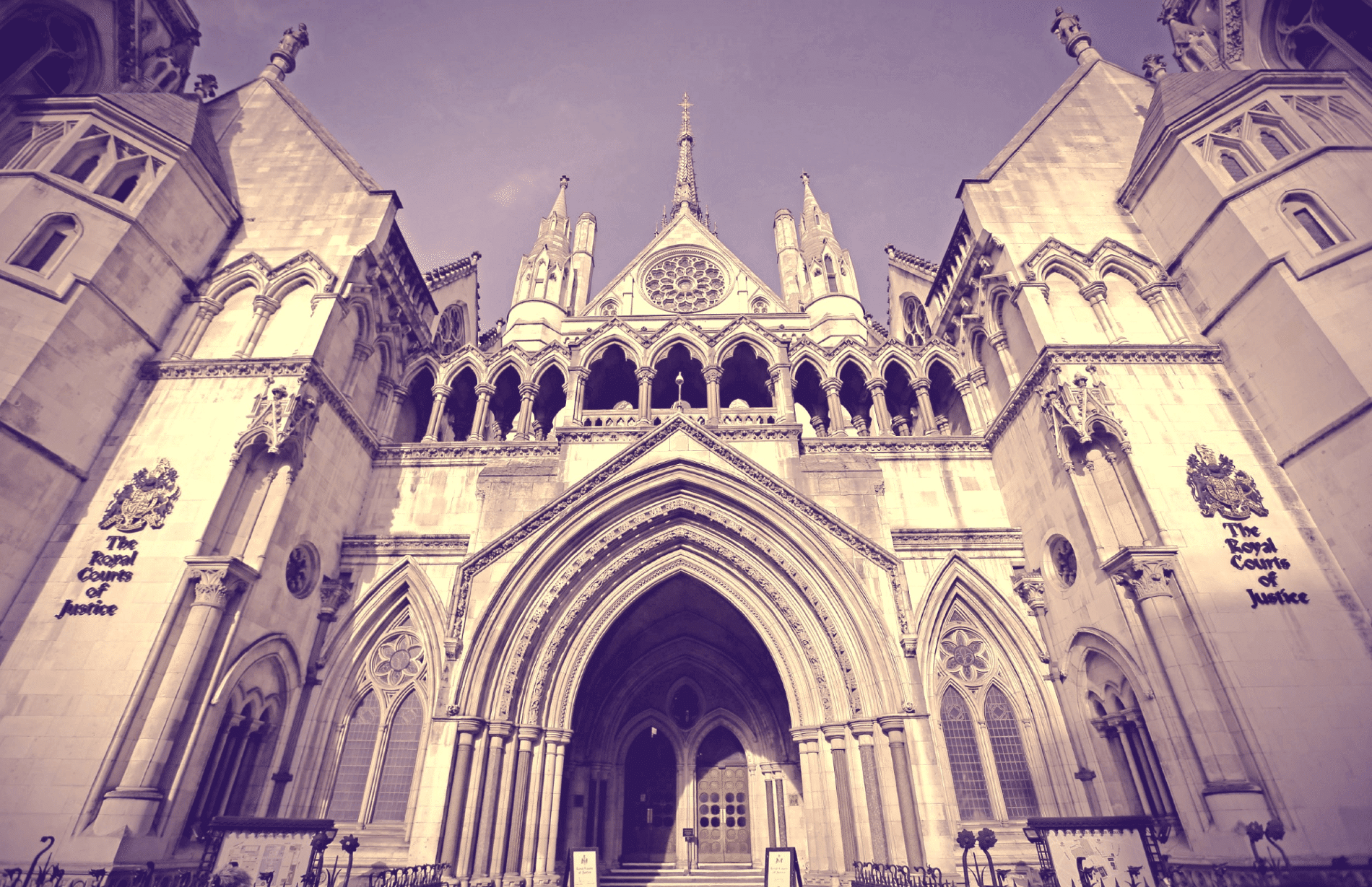

The High Court claim alleges not only that the bank mislead Wenta over the risk of the deal, but that two of the bank’s senior figures sat on the business’s board and encouraged it to subscribe to the interest rate hedging product.

Several large banks have resolved many high-profile hedging product mis-selling cases, but Wenta’s lawyers at LEXLAW, a London legal practice, claim “RBS and NatWest have been slow to resolve disputes and they have many litigation claims pending”.

The case is currently going through a court-ordered mediation, which could arrive at a settlement today. RBS and NatWest will not comment “because of ongoing litigation”, but it understood that the banks argue that the hedging product transaction met its review sale standards.

Wenta’s lawyer is Ali Akram, a partner at LEXLAW, an alternative business structure that includes both solicitors and barristers specialising in financial product mis-selling cases. He claims that RBS and NatWest had a “serious conflict of interest” when they advised Wenta to enter the hedging deal as “one of its own bank managers sat on the Wenta board and recommended the deal go through”.

Wenta’s chairman, Chris Pichon, who was recently given the Queen’s lifetime achievement award for enterprise promotion, told The Brief:

“We know we were mis-sold this product by RBS who were introduced to us by NatWest. Both banks have refused to acknowledge their wrongdoing over many years and this forced us to litigate.

“The sums involved may be small beer to these big banks, but to Wenta and the small businesses we help incubate they are game-changing monies that have been wrongly taken from us.”