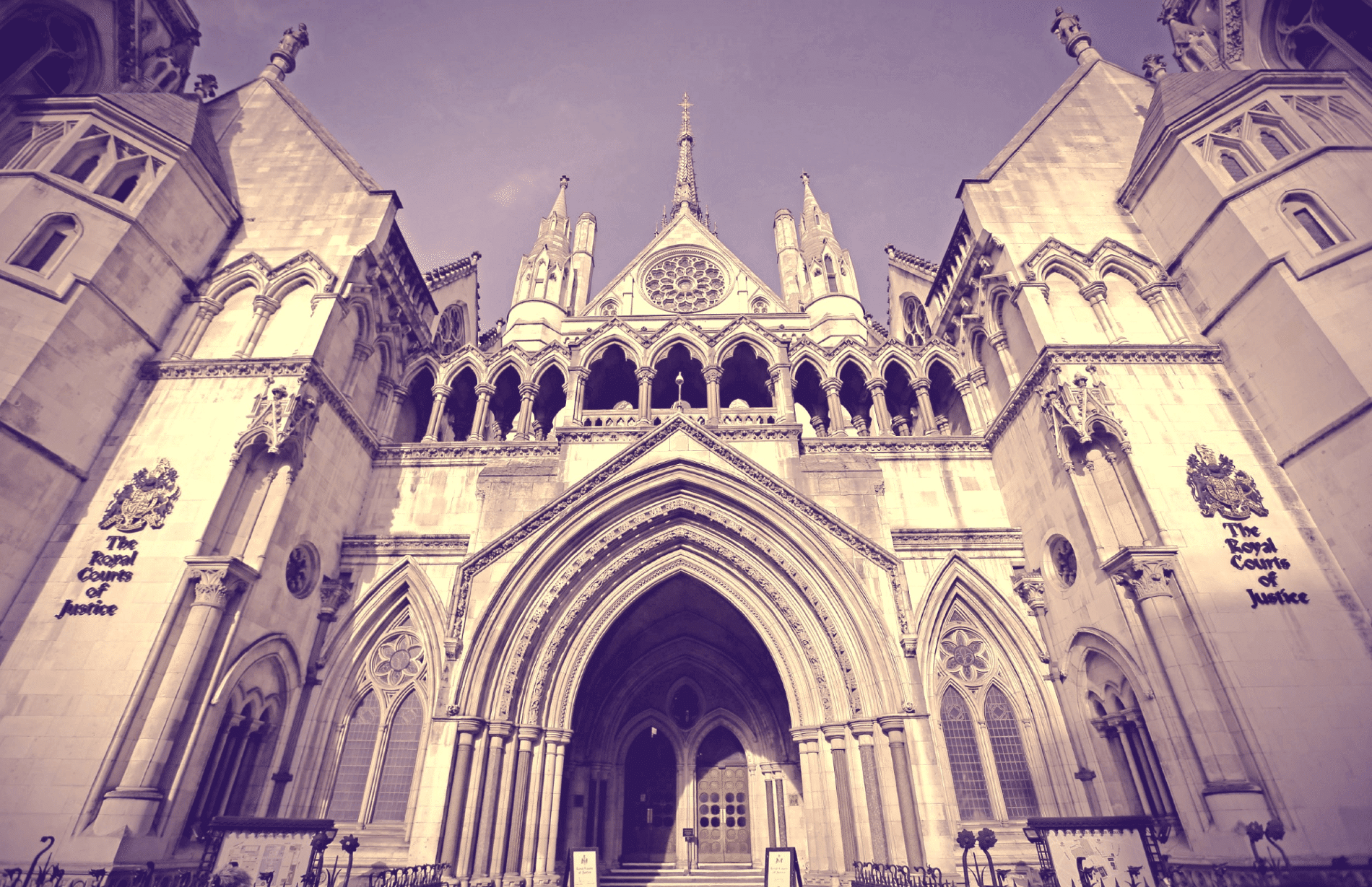

High Court slams Dentons and RBS for “cavalier” attitude to disclosure

A Financial List judge has determined Dentons and Royal Bank of Scotland to be “cavalier” in failing to comply with a disclosure order handed down last year in…

A Financial List judge has determined Dentons and Royal Bank of Scotland to be “cavalier” in failing to comply with a disclosure order handed down last year in…

Kiki Loizou, Small Business Editor of The Sunday Times, reports on one of our derivatives litigation cases where Barclays Bank plc mis-sold a highly toxic derivative (a 27-year…

The Royal Bank of Scotland PLC (RBS.L) has settled a High Court claim [1] over the mis-selling of two complex collar derivatives [2] in 2007 to Mehnaaz Chaudhry, a businesswoman…

The Times Brief reports that a company with a Queen’s award for its work in boosting British entrepreneurs is suing two of the country’s biggest banks after they…

Westgate Healthcare settled a legal dispute with RBS for £10m, involving alleged misrepresentation and breach of contract regarding an interest rate swap. Deemed too sophisticated for FCA’s compensation scheme, Westgate’s claim, initiated in April 2014, led to a settlement with RBS, who imposed confidentiality and accepted no liability.

The High Court ruled that fraud allegations against RBS concerning LIBOR manipulation in a derivatives mis-selling claim were “properly arguable,” affecting SMEs sold IRHPs by major banks. LIBOR, a crucial interest rate benchmark, had been rigged by banks including RBS, resulting in hefty fines. RBS admitted misconduct in its LIBOR submissions. Property Alliance Group’s (PAG) case against RBS may set a precedent for extending time limits on claims, emphasizing the importance of seeking legal advice on mis-selling claims affected by LIBOR fraud.

The High Court has decided that it is arguable that major banks owe duties of care to their SME customers to conduct the FCA Interest Rate Hedging Product…

The Sunday Times reports on the largest ever publicly disclosed settlement of an interest rate swaps mis-selling case. The derivatives in question were sold to a Care Home by Lloyds…

Kiki Loizou, of The Sunday Times, reports on our Financial Services Litigation team’s recent successful settlement of a swaps mis-selling litigation case. A multi-cancellable swap was sold to…

LLOYDS BANK – INTEREST RATE HEDGING PRODUCT (IRHP) MIS-SELLING £4.6 MILLION GBP LITIGATION SETTLEMENT WITH SME CARE HOME LONDON, UK – Lloyds Bank Plc (LLOY.L) has settled a High…